What we offer

Online Equity Trading

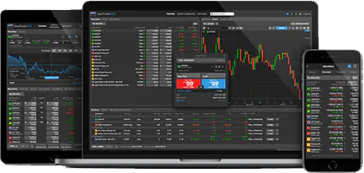

VSE’s unique trading platform offers a single screen online equity trading facility to our customers.

Offline Equity Trading

We offer telephonic trading services by way of assigning dedicated representative to cater to your transactional needs.

Derivatives

Derivatives trading gives you opportunities to participate in the various exchanges.

Commodities

As demand for goods and services increases, so does the price of the commodities/raw materials used to produce those goods and services

Currency Futures Trading

VSE have great hope in the tremendous prospects of currency futures and firmly believe it to be force to reckon with in the Indian financial landscape

Mutual Fund Trading with SIP, SWP, STP

Clients are able to trade from the convenience of their homes with a Relationship Manager in the financial markets

Fixed Income

Fixed Income securities is a debt instrument issued by a government, corporation or other entity to finance and expand their operations.